20+ Capitalized interest

The capitalization period is the period for which the expense will be capitalized. Capitalized interest is an accounting practice required under the accrual basis of accounting.

/dotdash_INV_final_Capitalization_Ratios_Jan_2021-01-39b098a2a4f645ddb752bbd1887a488c.jpg)

Capitalization Ratios Definition

In a nutshell capitalized interest is the addition of unpaid interest charges to the balance of a loan.

. Interest is capitalized in order to obtain a more complete picture of the total acquisition cost associated with an asset since an entity. Finally we calculated capitalized interest expense. 835-20 Capitalization of Interest.

This Subtopic establishes standards of financial accounting and reporting for capitalizing interest cost as a part of the. Under Topic 835-20 Capitalization of Interest what amount of interest may initially be capitalized as part of the initial investment in an asset for certain. When you make monthly payments on a student loan a portion of your payment goes toward the.

Pursuant to ASC 835-20 the capitalization rules for interest. During construction of a debt-financed project interest costs must be capitalized as part of the cost of the asset or assets. Assets that are constructed or otherwise produced for an entitys own.

That means youll pay about 40 extra per month. Capitalized interest is interest that is added to the total cost of a long-term asset. Its interest is capitalized because it is calculated not only on the principal but also on the interest added to the original.

ASC 835-20 notes the following. 00 Status 05 Background 10 Objectives 15 Scope 20 Glossary 25 Recognition 30 Initial Measurement 35 Subsequent Measurement 40. A capitalized interest loan is a type of credit in which.

Codification Topic 835-20 Capitalization of Interest Capitalization of interest SFAS 34 October 1979 Capitalization of Interest Qualifying assets for interest capitalization 1. It typically arises when loan payments are paused for a period of time. The amount of capitalized interest is the amount of average expenditures multiplied.

When to capitalize interest. Then we allow weightage to each of the capitalized items. Capitalized interest is the total sum of unpaid interest that is added to the principal loan.

When you leave school that interest is capitalized into your loan leaving you with a total loan of 34800 to repay with interest. When to capitalize interest. View all combine content.

Interest shall be capitalized for the following types of assets qualifying assets. A depreciable class life of 20 years or more or An estimated. Capitalized interest is unpaid interest that gets added to your loan balance.

It is a significant aspect of financing that helps a business grow and expand as. Accounting questions and answers.

Accounting Exam 2 Flashcards Quizlet

The Us Benchmark Discount Rate Vs The Fed Interest Rate Download Scientific Diagram

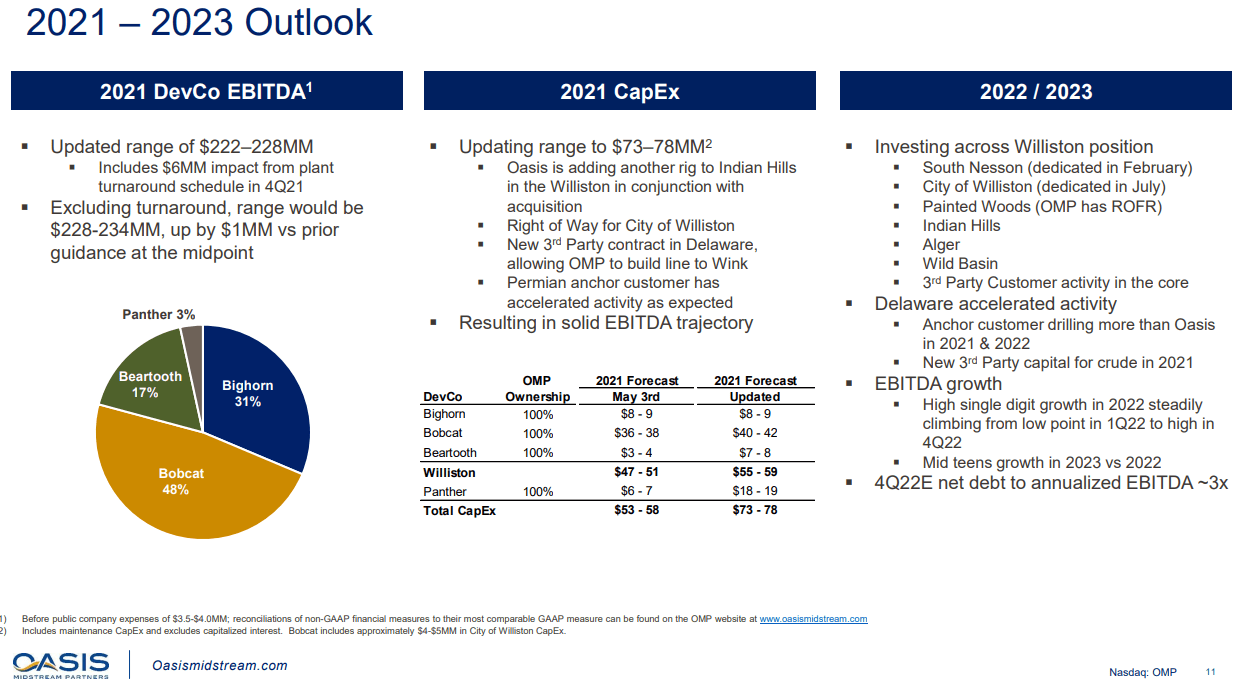

Ex 99 1

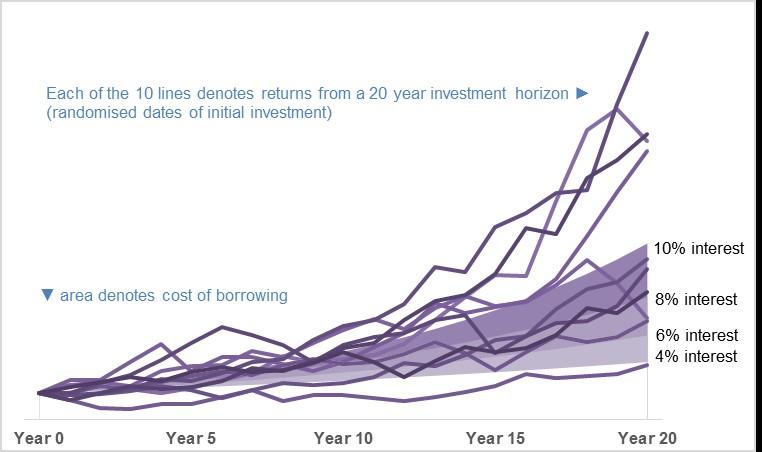

Is Leverage In Long Term Investing Worth The Risk Seeking Alpha

100 Words Adjectives To Describe Yourself Interview Tips

Enron Scandal The Fall Of A Wall Street Darling

June 2022 Market Update Waiting For The Fog To Go Two Centuries Investments

Crestwood Acquires Oasis Midstream Great For Preferreds Seeking Alpha

The Evolution Of Banks Average Interest Rate Spreads And Market Download Scientific Diagram

2

Quantitative Value Investing Is Broken Applied Finance

In Divorce Is The Double Dip Concept A Misconception Family Lawyer Magazine

425

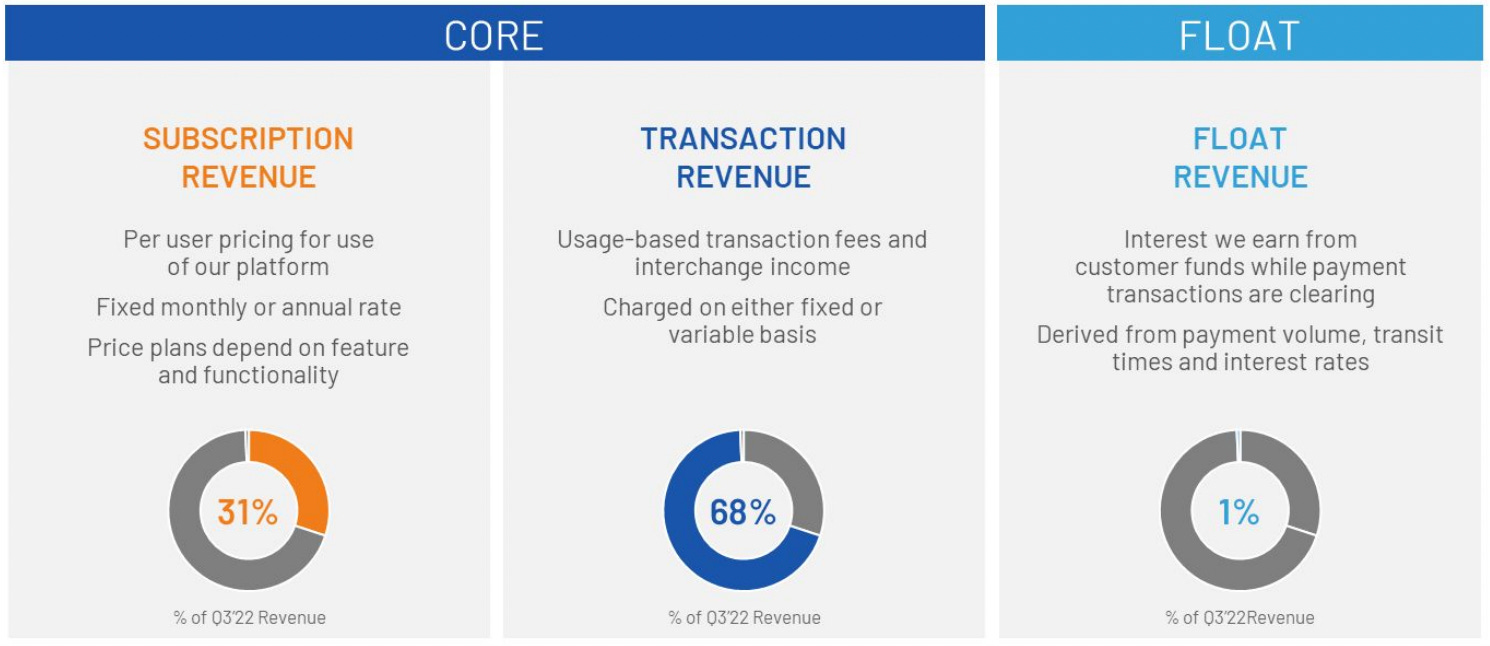

Bill Com Profile Automating Payments For Smbs

June 2022 Market Update Waiting For The Fog To Go Two Centuries Investments

425

/dotdash_INV_final_Capitalization_Ratios_Jan_2021-01-39b098a2a4f645ddb752bbd1887a488c.jpg)

Capitalization Ratios Definition